Has Orwell’s Big Brother already captured our “inner faith”?

Dominic Green titles his review of D.J. Taylor’s “Orwell: The New Life” as “The Conscience of our age” and rubs it in with: “Eric Blair (George Orwell’s first name) created Orwell to be the conscience of his age, and Orwell became the conscience of ours”

Sadly, that conscience has by far been insufficient.

Green writes Orwell believed “the centralizing modern state is the enemy of decency” and in “Notes on Nationalism” Orwell wrote: “One has to belong to the intelligentsia to believe things like that: no ordinary man could be such a fool.”

And yet, when a group of technocrats in a mutual admiration club, the Basel Committee for Banking Supervision, overflowing with hubris thinking they know all about risks, in 1988 imposed risk weighted bank capital/equity/skin-in-the-game requirements, with decreed weights 0% government – 100% Citizens, the world, after many decades, still keeps silence.

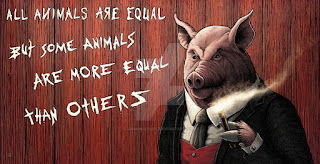

Can’t you hear Napoleon announcing? “To make your bank system safer, here we give you our risk weighted bank capital requirements. These decree the more creditworthy, Me & my Apparat-Pigs, more worthy of credit, and you, less creditworthy, less worthy of it.” And all the animals on the farm saying: “Thanks Napoleon!”

And to add salt to injury D.J. Taylor/Green reminds us that Orwell opined that the centralizing modern state was the enemy of decency, and he believed that modern totalitarians differed from the tyrants of the past because technology would allow them to breach the window into men’s souls. In “Nineteen Eighty-Four”, the torturer O’Brien demands more than outward conformity. He demands inner faith.

“The rules are simple: they lie to us, we know they're lying, they know we know they're lying, but they keep lying to us, and we keep pretending to believe them.” From "A Mountain of Crumbs" by Elena Gorokhova.

And how is the farm doing? Just look at the growth, in peace time, of the outstanding level of debt managed by the Bureaucracy Autocracy.

Technology? Like artificial intelligence, like central banks digital currency, like digital ID, like polarization with the aid of social and main media?

2015, walking in Singapore I observed “I don’t see any police on the street”. I was told “Don’t worry they see you” Friends, look up, behind that camera, one of Napoleon’s Pigs is watching you.

"Since I and my Pigs, know better what you should do with your money, I give you my central bank digital currencies, CBDC."

Will we, the other on the farm, say "Thank you Napoleon"?

"We Pigs, to make absolutely certain that others do not put you other in any danger, we give you our digital ID."

Will we, the other animals on Orwell’s farm say: “Thank you Napoleon!"?

Now the question is: Artificial Intelligence is a child of Human Intelligence. What happens if their umbilical cord is cut?