Tuesday, October 08, 2019

When I grow up, I want to be a candidate in as many elections as possible, in order to use social media creatively, including threats, and solicit donations from millions at a zero-marginal cost.

It seems such a great business, wouldn’t you agree daddy?

When I grow up, I’m thinking of entering the polarization business. Being as extreme as possible and using social media at a zero marginal to solicit donations from those I can convince I’m their best chance.

It seems such a great business, wouldn’t you agree daddy?

When I grow up, I’m thinking of becoming a redistribution profiteer. Offering to tax the wealthy the most, could create great opportunities for me, whether with the wealthy or with the poor, or perhaps with both

It seems such a great business, wouldn’t you agree daddy?

When I grow up, I’m thinking of becoming a great vote fisher. I mean one of those anglers who, as a fishing bait, offers to make other, by force, pay for their generous promises.

It seems such a great business, wouldn’t you agree daddy?

Daddy, when I grow up, I’m thinking of becoming a bank regulator or supervisor. It seems such a safe job.

Have you seen what has happened to those jobs since the global financial crisis? It sure looks as the more you fail the more jobs there are.

Absolutely son, these are so much better businesses than plastics.

PS. I just remembered... becoming a price regulator is a great option too.

PS. Daddy, when I grow up, I feel I should be a public voiceful admirer of any great “wealthy and powerful transformational leader”. Is that not a great business?

PS. Daddy, when I grow up, should I not aspire to become an artificial intelligence regulator. That sure sounds like the cherry on top of the icing on a cake.

Wednesday, September 11, 2019

Financial communism

And when reading this, don't just take my word on it:

“Assets for which capital requirements were nonexistent, were what had most political support: sovereign credits A simple ‘leverage ratio’ discouraged holdings of low-return government securities"

Is the current ultra low or even negative interest rates on sovereign debt something weird?

Of course not: a) take away all central banks purchases of public debt with QEs, which helped to keep the saving glut intact or even increase it; b) get rid of regulations that assign the lowest risk weights and thereby the lowest capital requirements for banks to the borrowings of the sovereign monarch; c) take away liquidity requirements that have banks buying sovereign debt; d) stop making pension funds and insurers having to buy “safe” government debt irrespective of the price; and e) stop central banks from paying negative returns… and you would not see public debt bought and sold at ultra-low, much less negative rates.

What we are really suffering from is a well-disguised and utterly creative and non-transparent financial statism of monstrous proportions, which impedes the markets to signal what the undistorted interest rate on sovereign debts should be.

The difference between the interest rates sovereigns would have to pay on their debts in absence of all above mentioned favors, and the current ultra-low or even negative interests they pay is, de facto, a well camouflaged tax, retained before the holders of those debts could earn it.

And, if ignoring the risk of inflation, one could argue sovereign debts issued in their own domestic/printable fiat currency is safer, and should therefore have lower capital requirements, but, the other side of that coin, is that it really implies that government bureaucrats would know better what to do with bank credit they're not personally responsible for, than for instance private entrepreneurs who sign their own name on bank loans to them.

So if we consider the non-transparent regulatory subsidies for sovereign debt, and the effects of central banks purchasing so much of it, as we should, the already so scary fiscal deficits are even larger than reported

I have the nagging feeling that the market value of sovereign debt much more accurately represents the real debt burden faced by those sovereigns than the par value of it. And that that market value could currently be a scary number in relation to GDP.

And after having thereby empowered the Bureaucracy Autocracies, many of those statism profiteers shamelessly blame our difficulties on the usual scapegoat… neoliberalism

PS. The fact is that I could just as well titled this as "Financial fascism"

PS. 2004, in a letter published in the Financial Times I wrote: “Our bank supervisors in Basel are unwittingly controlling the capital flows in the world. How many Basel propositions will it take before they start realizing the damage, they are doing by favoring so much bank lending to the public sector.”

PS. Before the debt ceiling is lifted, which it must be, Congress must dare to at least pose a question.

PS. Was that’s not a valiant, courageous and honorable confession by Paul Volcker? Thanks @PostOpinions for not ignoring it.

Friday, August 30, 2019

My four long-time held principles for a good restructuring of Venezuela’s/Pdvsa’s debt.

A restructuring to be initiated when its corrupt, inept criminal and human rights violating regime has been thrown out and law, justice, democracy and respect for private property has returned.

1. Not only for Venezuela’s sake, but also for all the citizens of the world’s sake, exploit Venezuela’s debt problem in order to establish clear definitions of what should be considered bona fide credits and what odious credits, and what different treatment should be given to these.

2. Align the incentives of the creditors so as to work for having Venezuela’s economy grow instead of extracting from is economy whatever they can. In Venezuela’s case that is quiet straightforward. Have the creditors identify and help finance who can in the shortest-term possible, increase the oil it extracts and exports.

3. In order to align the incentives that will allow such debt restructuring to take place in peaceful and sustainable terms, have all the nations’ net oil revenues to be shared out 15% to its creditors, 34% to Venezuela’s central and local governments, and 51% equally among all Venezuelans.

4. Before the three aforementioned conditions have been formalized Venezuela should thankfully, gratefully accept all humanitarian help given but should not waste one cent of all those bridge loans from here to there that it could be offered, for instance by the IMF.

That should help Venezuela’s legitimate creditors to recover their loans, its government to have to rely more on what the citizens pays it in tax so as to be held more accountable and, foremost, allow Venezuelans to live in a nation and not just in somebody else’s business.

Monday, August 12, 2019

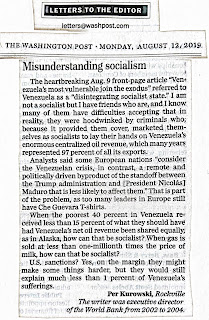

Misunderstanding socialism

The heartbreaking Aug. 9 front-page article “Venezuela’s most vulnerable join the exodus” referred to Venezuela as a “disintegrating socialist state.” I am not a socialist but I have friends who are, and I know many of them have difficulties accepting that in reality, they were hoodwinked by criminals who, because it provided them cover, marketed themselves as socialists to lay their hands on Venezuela’s enormous centralized oil revenue, which many years represented 97 percent of all its exports.

Analysts said some European nations “consider the Venezuelan crisis, in contrast, a remote and politically driven byproduct of the standoff between the Trump administration and [President Nicolás] Maduro that is less likely to affect them.” That is part of the problem, as too many leaders in Europe still have Che Guevara T-shirts.

When the poorest 40 percent in Venezuela received less than 15 percent of what they should have had Venezuela’s net oil revenue been shared equally, as in Alaska, how can that be socialist? When gas is sold at less than one-millionth times the price of milk, how can that be socialist?

U.S. sanctions? Yes, on the margin they might make some things harder, but they would still explain much less than 1 percent of Venezuela’s sufferings.

Per Kurowski, Rockville

PS. The "[President Nicolás]" was inserted by WP, they placed it within brackets, for me Venezuela's legitimate President is currently Juan Guaidó.

Thursday, July 04, 2019

My Fourth of July 2019 tweets to the United States of America

This Fourth of July 2019 here are two tweets in which I expressed, to that United States of America that I admire and that I am so grateful to, some very heartfelt concerns.

In 1988 America signed on to the Basel Accord’s risk weighted capital requirements for banks.

These gave banks huge incentives to finance what was perceived as safe, and to stay away from the “risky”.

It is so contrary to a Home of the Brave, opening opportunities for all.

And regulators decreed risk weights: 0% sovereign, 100% citizens

That implies bureaucrats know better what to do with credit than entrepreneurs

That has nothing to do with the Land of the Free, much more with a Vladimir Putin’s crony statist Russia

PS. Why “grateful”? Had my father, a polish soldier not been rescued by American’s from a German concentration camp April 1945, I would not be.

PS. As one of those millions Venezuelan in exile, I know my country’s future much depends on America’s will to support its freedom.

Tuesday, June 18, 2019

I saw Netflix’ documentary on Alexandria Ocasio-Cortez

It is a great type of Hallmark flick, made by and for anti their establishment progressive activists.

Don’t get me wrong, I love Hallmark movies, and I am quite a bit of anti establishment myself, but, sadly, it takes much more than Hallmark happy endings, to help provide real and good solutions to our many real Main Street problems

Problem: Our economy, much because of regulatory distortion of the allocation of bank credit, has over ingested an unproductive debt. How to come down from that debt high is a mindboggling challenge.

Problem: Politicians who support minimum wages support the class of working people that have a job. But what about the not-working class, the people that do not have a job or do not want to be displaced from a job by artificial intelligence or robots?

Problem: The excessive importance given to house ownership and the excessive ease of financing of house purchases so as to make these affordable have caused houses to morph from being homes into being investment assets. So what about the class with no houses?

Problem: We face serious environmental challenges but how can we afford to face these when so many are out to profit financially, politically or by just feeding their narcissism, from the fight against climate change?

Problem: Being able to feed messages of hate, envy or just fake news, at zero marginal cost on social media, is polarizing to death our societies. How do we solve that without it all of us just ending up in the hands of a Big Brother?

Problem: Growing inequality and poverty. How can we face those challenges without causing the economy to shrink? The sole redistribution of wealth is clearly not the answer, since all after tax income that produced the wealth, is now frozen in assets

Problem: Student debt is a great problem. But how can we solve it without the solutions, like debt forgiveness, creating moral hazards and just opening space for further increases in educational costs?

Problem: How can we be able to launch a so needed unconditional Universal Basic Income when so many redistribution profiteers will fight with tooth and nails against seeing the value of their franchise decrease?

Problem: And if you think only America has problems just have a look at the European Union with its ticking 0% Risk-Weight Sovereign Debt Privilege bomb. That is truly scary stuff.

PS. Among AOC’s first actions was, thinking that tax cuts meant giving away money to Amazon and not just to take less money from it, to help scare away Amazon with its 25.000 well paying jobs. That was like telling New York, "The City That Never Sleeps", to take a Big Siesta. Given its shaky finances, I have a feeling that was not much appreciated by her general constituency, so there might not be a sequel to this documentary.

PS. Who can stand up better for the future of our grandchildren than we grandparents?

Monday, May 27, 2019

If I had been elected a first time EU parliamentarian

If I was a newly elected first time European Union parliamentarian, the following is what I would ask in order to leave a clean historical record of my presence there:

Fellow parliamentarians: I have heard rumors that even though all the Eurozone sovereigns take on debt denominated in a currency that de facto is not their own domestic printable one; their debts, for the purpose of the risk weighted bank capital requirements, have been assigned a 0% risk weight by European authorities. Is this true or not?

If true does that 0% risk weight, when compared to a 100% risk weight of us European citizens not translate into a subsidy of the Eurozone sovereigns’ bank borrowings or in fact of all Europe's sovereigns?

If so does that not distort the allocation of bank credit in the sense that the sovereigns might get too much credit and the citizens, like European entrepreneurs, get too little? And if so would that not signify some regulators, behind our backs, have imposed an unabridged statism on our European Union?

And if so, does that not mean that some Eurozone sovereign could run up so much debt they would be seriously tempted to abandon the euro and thereby perhaps endanger our European Union?

Finally, was Greece awarded such a 0% risk weight? If so was this monumental fault by EU authorities taken in consideration when restructuring its debts? And if not, does that not show a basic lack of solidarity with a EU member?

Who should answer these questions? The European Commission?

Oops... it seems that it was the European Parliament through a "Council on prudential requirements for credit institutions and investment firms" that concocted the idea.

PS. In March 2015 the European Systemic Risk Board (ESRB) published a report on the regulatory treatment of sovereign exposures. In the foreword we read:

"The report argues that, from a macro-prudential point of view, the current regulatory framework may have led to excessive investment by financial institutions in government debt.

The report recognises the difficulty in reforming the existing framework without generating potential instability in sovereign debt markets.

I trust that the report will help to foster a discussion which, in my view, is long overdue. Mario Draghi, ESRB Chair"

So Mario Draghi, as president of the European Central Bank since 2011, what have you done about it, or is it your intention to leave that very hot potato to your successor?

PS. In that ESRB report there are references to "domestic" currency but not to the fact that the euro is not really a domestic currency of any of the eurozone sovereigns.

Thursday, May 09, 2019

I have some ideas about what could compete with Facebook/Twitter

Chris Hughes, a co-founder of Facebook, a co-chairman of the Economic Security Project and a senior adviser at the Roosevelt Institute opines in the New York Times:

“No one knows exactly what Facebook’s competitors would offer to differentiate themselves.”

I have some ideas (most apply to Twitter too):

1. That it guarantees that I am always messaging or receiving messages from parties that I can clearly and absolutely accurately identify, with ease.

2. That I am targeted in an at least a 95% perfect way, so that my already way too scarce attention span is not being further wasted away by irrelevant/useless advertising/information.

3. That it shares with the participants 50-50 all advertising revenues generated by exploiting their data. Either to each one his respective production quota, or by means of helping to fund a universal basic income.

4. That it does it utmost to keep out all those redistribution or polarization profiteers whom, with their messages of hate or envy, can destroy our societies.

5. That it swears never ever to form any type of joint venture, with any type of Big Brother.

PS. Should we at least, as a minimum-minimorum, not require all social media with over a million followers, to openly publish the algorithms they use to maximize their ad revenues?

Monday, April 08, 2019

A brief comment on Joseph E. Stiglitz “The EURO: How a common currency threatens the future of Europe”

Professor Stiglitz correctly describes many of the challenges the Euro poses, most of which were known from get-go twenty years ago, like the problem derived from having fixed exchange rates within the Eurozone.

In the introduction to the paperback edition, Stiglitz also briefly brings forward something that should have been understood but seems to have been much ignored. That is that although the Euro is for most purposes the domestic currency in the Eurozone, it is de facto not a truly domestic currency for any of its sovereigns, since none of these have the right to individually print the Euros it wants or needs. Without that right, the Eurozone’s sovereigns’ debts are all, de facto, denominated in a quasi-foreign currency.

But what the book does not mention, is what came afterwards, I do not know exactly where and when; something that here and there is referred to, in hush voices, as Sovereign Debt Privileges. These translate into that the EU authorities (European Commission?), for the purpose of the risk weighted capital requirements for banks, assigned all Eurozone nations an insane 0% risk weight.

That distortion in favor of Eurozone’s sovereign’s accesses to bank credit has impeded the markets from sending the correct market signals with respect to the interest rates for each sovereign.

One of the consequences of this has been the tragedy of Greece. Especially since Greece was then forced up to pay up basically on its own for this EU mistake, so as to bail out German, French and other Eurozone banks. What a Banana Union!

As for Professors Stiglitz opinions on Brexit I might resume those I my own words as “If there's a Remain there might not be a EU in which to remain”, something that would be very sad as EU was, and still can be, a very beautiful dream.

But let me be clear. I do not hold the EU authorities as solely responsible for the consequences of their 0% risk weighing of the Eurozone Sovereigns. Already in 2011, in a post titled “Who did the Eurozone in?” I argued that the extraordinary low risk weights that the Basel Committee assigned to sovereign debt when compared to what it assigned to the private sectors would end in tears. (And that goes not only for the Eurozone)

Tuesday, March 26, 2019

Three tweets on the Greek Tragedy

What if Alexis Tsipras and Yanis Varoufakis, while negotiating the debt of Greece with the Troika of the European Commission, the European Central Bank and the IMF, had brought up EU’s “Sovereign Debt Privileges”, and then argued:

Though our debt is in a currency that de facto is not a domestic printable one, you assigned Greece 0% risk weight. That meant European banks could lend to us against zero capital. You expected our governments to resist the temptations of too easy credit

And now you want our children and grandchildren to pay for all the need of bailing out your banks? Have you no shame?

Shall we take you to court? Shall we inform your constituency about your insane 0% risk weighting of Greece? Or shall we renegotiate?

Saturday, February 16, 2019

My tweet on IMF loans to Venezuela

If IMF and friends would give loans around $60bn to Venezuela to help it recover, a big chunk of it, about 35%, should go in cash to all its citizens, e.g. $60 per month each, allowing the markets freely respond to their needs, without any bureaucratic intermediation from above

Si FMI y amigos diesen préstamos tipo $60 mil millones a Venezuela para su recuperación, gran parte, aprox. 35%, debería ir en efectivo a sus ciudadanos, p. ej. $60 por mes c/u, permitiendo que los mercados libremente respondan a sus necesidades, sin intermediación burocrática

Friday, February 01, 2019

There are two de facto class wars, which seemingly shall not be named

On these where do you stand? Do you take a side, or do you prefer to conveniently ignore it?

Sunday, January 27, 2019

Redistribution profiteers have a vested interest in hindering people from reaching the pot they promise will be there waiting for them, at the end of their Marxists rainbow.

"From each according to his ability, to each according to his needs"

In the Marxist view, such an arrangement will be made possible by the abundance of goods and services that a developed communist system will produce; the idea is that, with the full development of socialism and unfettered productive forces, there will be enough to satisfy everyone's needs

I do not agree. First and foremost because I believe that free markets (capitalism) has by far the greatest capacity to extract the most from the citizens’ abilities.

But also because, while traveling on such Marxist route, some few would have to redistribute any production of goods and services that is insufficient to satisfy the demand. And those taking the decisions fall too much in love with the political and financial profits such redistribution franchise can produce. As a consequence, the redistribution profiteers will never want to let loose of their power and their interference will never allow the production of abundance.

That said, as a citizen, I can nonetheless see the need for some redistribution of income and wealth to occur, not only in order to keep our society at peace but also out of simple plain need of social justice. For that I firmly believe the redistribution should primarily be done, not top down, but bottom up.

An unconditional universal basic income would do so and it would also be the best way of keeping the distortion of the productive forces of a free market at minimum.

That societal dividend would have to absolutely meet two criteria:

Be large enough to help you out of bed but never large enough to allow you stay in bed.

Be 100% fiscally sustainable, nothing of having our grandchildren pay for our income today.

It should be easy to understand why the redistribution profiteers abhor the UBI… and one of their arguments against are precisely: that it will inspire laziness and keep people in bed; and proposing that it should be so big so as to guarantee its fiscal unsustainability, so that they will have to be kept in their role as redistributors.

There are many funding sources for an UBI. In an oil exporting country obviously those oil revenues should be a prime source, as already done in Alaska.

Though in Spanish, below is a short YouTube in which three important members of the Chavez/Maduro Bolivarian Revolution, confess their need of keeping the poor poor:

Tareck El Aissami, former Vice President and current Minister of Industries and National Production: “The poorer people are, the more loyal to the revolutionary project they are, and the more love for Chávez they have"

Héctor Rodríguez, a former Minister of Education and currently the Governor of Miranda: "It is not that we are going to lift people out of poverty into the middle class so that they later aspire to be scrawny (a derogatory term used for the opposition)"

Jorge Giordani, four times Minister of Planning, “Our political strength is given to us by the poor, they are the one who votes for us and that’s why our discourse of defending the poor. The poor will have to remain poor, we need them so.”

Saturday, January 12, 2019

Here’s the moment it struck me that if Brexit falls apart, there might not be a EU for Britain to remain in.

It’s now twenty years since the Euro was introduced, more in order to strengthen a union than the result of a union. As I wrote in an Op-Ed at that time, it brought on important challenges to its 19 sovereigns. First it meant giving up the escape valve of being able to adjust their currency to their individual economic needs and realities, and second, much less noticed, also by me, was that they would hence be taking on debts in a currency that de facto was not denominated in their own domestic (printable) currency.

To face those challenges required the Eurozone to extend much more the Euro mutuality to other areas, like to monetary and fiscal policies. In that respect there’s no doubt that way to little has been done.

For more than a decade I thought the Eurozone applied Basel Committee’s Basel II standardized credit rating dependent risk weights in order to set the capital requirements for banks, when lending to sovereigns. I never approved of that because I considered those risk weight way too statist, tilting bank-lending way too much in favor of the sovereign and against the citizen... and that should do the Eurozone in.

But then, by mid 2017, I found out that it was all so much worse. EU authorities, most probably the European Commission, I really do not know who and when, assigned all Eurozone sovereigns a 0% risk weight, even though none of these can print euros on their own.

I could not believe it. That meant that European banks could hold sovereign debt, of for instance Greece, against no capital at all. How could something crazy like that happen? That basically doomed the Euro. What would have happened with USA if it had done the same thing with its 50 states?

How on earth can it now get out of that corner it has been painted into, especially when Europeans sing their national anthems with so much more emotion than EU’s anthem, Beethoven’s Schiller’s “Ode to Joy”

How on earth can it now get out of that corner it has been painted into, especially when Europeans sing their national anthems with so much more emotion than EU’s anthem, Beethoven’s Schiller’s “Ode to Joy”

And that’s the moment it struck me that if Brexit falls apart, there might not be a EU for Britain to remain in.

My November 1998 Op-Ed "Burning the bridges in Europe"

PS. When Greece fell into the trap then EU authorities had it sign a Versailles type treaty.

PS. When Greece fell into the trap then EU authorities had it sign a Versailles type treaty.

We citizens need a clear global definition on what constitutes odious credits to sovereigns.

A letter to the Washington Post (not published)

I refer to Washington Post’s “Jaw-dropping corruption” recounting illicit investment relations between China and Malaysia, January 12.

It shows that though there have been discussions on odious debts, odious credits merits perhaps even more attention.

For decades I have begged for the establishment of clear and defined international rules that, either because of corruption or too nonchalant credit analysis or due diligence, should declare credits as odious, and therefore null, or at least not enforceable through normal channels.

In 2004 I published an Op-Ed titled “Odious Credit” in El Universal, Caracas. Can you imagine how much odious financing Venezuela could have avoided to contract with China, had such regulations been in place?

There’s way too much global camaraderie between governments all interested in taking on debt. We need much more global camaraderie between citizens interested in their governments not contracting odious debts.

Monday, January 07, 2019

The Chavez/Maduro Bolivarian Revolution, has confessed its need of keeping the poor poor

Though in Spanish, below is a short YouTube in which three important members of the Chavez/Maduro Bolivarian Revolution, confess their need of keeping the poor poor:

Tareck El Aissami, former Vice President and current Minister of Industries and National Production: “The poorer people are, the more loyal to the revolutionary project they are, and the more love for Chávez they have"

Héctor Rodríguez, a former Minister of Education and currently the Governor of Miranda: "It is not that we are going to lift people out of poverty into the middle class so that they later aspire to be scrawny (a derogatory term used for the opposition)"

Jorge Giordani, four times Minister of Planning, “Our political strength is given to us by the poor, they are the one who votes for us and that’s why our discourse of defending the poor. The poor will have to remain poor; we need them so.”

PS. So that the riskier small businesses and entrepreneurs who need credit, will need us more, and therefore vote for us more, we, the regulators of the Bureaucracy Autocracy, must set the risk weighted bank capital requirements especially high on loans to them.

Subscribe to:

Posts (Atom)